"Mileage" is a distance-based expense reimbursement to an employee if they use their private vehicles for business-related travel. Administrators have the option to automatically update their distance rates using the suggested IRS mileage rates.

Updating the Rate for a Mileage Expense Category

Logged in to Nexonia on the web:

- Click on the Settings icon

- Navigate to the Company > Expenses > Categories

- Scroll to the Mileage category you want to update, and click the Edit (pencil) icon to edit the category.

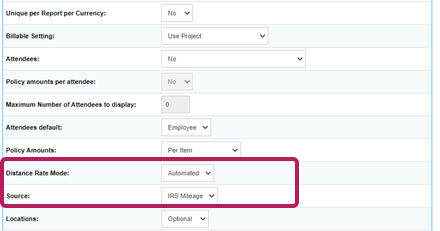

Scroll to the Mileage-related settings - they should be visible provided the category's Type is set to "Distance".

Scroll to Distance Rate Mode. Select Automated, then choose IRS Mileage as the Source of any automated mileage updates.

Please Note: The Distance Rate will be updated automatically via the IRS every January 1st.

Once you've completed the configuration for the mileage category, scroll to the bottom of the menu and click the Apply button to save this category and its new rate.

Comments

0 comments

Article is closed for comments.