Cash Advance

The "Cash Advance" expense category type represents an advance payment from the company to the user. It can be used in an expense report to indicate the amount advanced to an employee, who can then report expenses deducted from the Cash Advance.

The expense report will show any remaining amount from the Cash Advance. Any remainder of the Cash Advance may be tracked with a Cash Return category if needed.

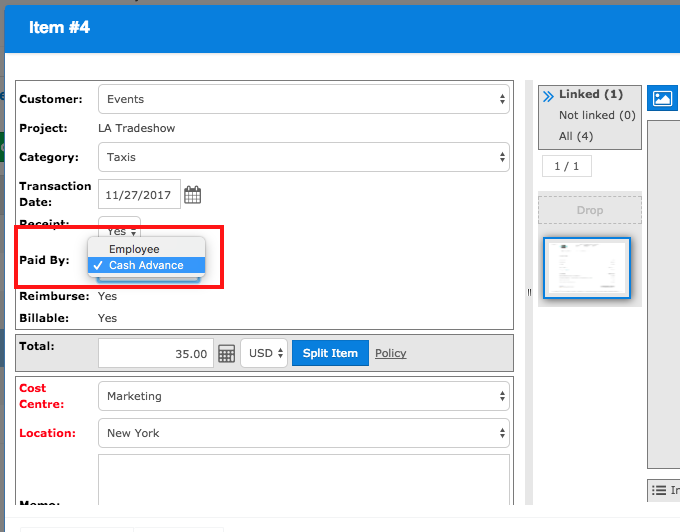

If an expense item of the Cash Advance category type is created in an expense report, any other expense item in that report that can be paid by the employee will contain a new selectable option to be paid by cash advance.

Below, you'll see an expense item from a report with a Cash Advance. For any expense items created, the user has an option under "Paid By" to indicate if the expense item was paid out of the cash advance.

In the example below, Aaron has a $500 cash advance (Item 1), and has paid for his trip expenses against it (Items 2 - 6), with a remainder of $7.00 shown under "Total Due" at the top of the report.

Cash Advance, Foreign Currency

If the Cash Advance is issued in a foreign currency, any expenses created using that advance will need to be in the same currency. The default exchange rate used for the item paid by cash advance will be based on the date from the item of category Cash Advance.

Cash Return

The Cash Return type represents a reimbursement of a previous cash advance from the user to the company. The opposite of Cash Return is Cash Advance, and because of this the amount of an expense item of this category type cannot be negative.

Creating a Cash Advance or Cash Return Expense Category

Logged in to Nexonia on the web:

- Click on the Settings icon

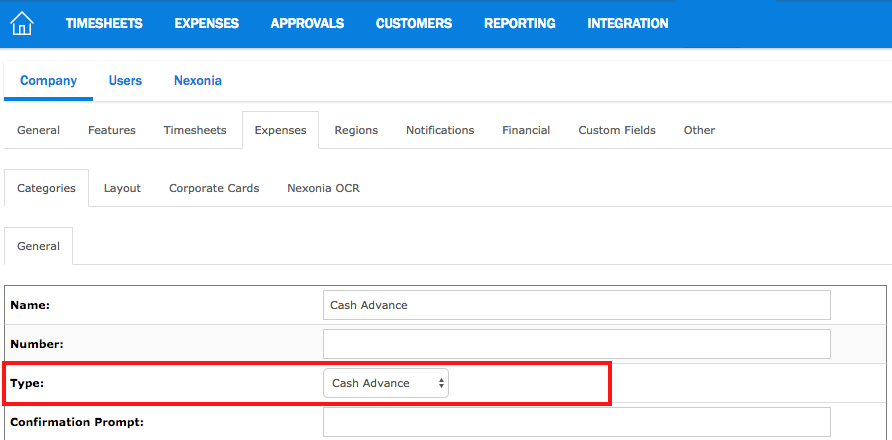

- Navigate to the Company > Expenses > Categories

- Click the Add button to add the new category and enter the details for category.

Note: for Intacct or NetSuite integrated accounts: create the new expense type(s) in your ERP, and run the Nexonia configuration sync to automatically create the new Nexonia expense category.

When configuring a Cash Advance/Return category, the main required setting is Type. Choosing either Cash Advance or Cash Return will enable the correct system behavior for this category.

Expense Category settings to consider:

Memo Requirement: if you want to ensure the expense submitter includes comments on the Cash Advance or Cash Return, make the memo "Required".

Receipt Default Value: if no supporting documentation is expected for a Cash Advance or Cash Return, switch the default value to "No". If you have any sort of document you expect the user to provide, they could attach it as a PDF "receipt" on the expense item - if so, switch default to "Yes".

Once you've completed the configuration for the Cash Advance or Cash Return category, scroll to the bottom of the menu and click the Apply button to save this category and its settings.

You may also be interested in the following articles:

If only certain users should have the Cash Advance or Cash Return category as an option, refer to: How to Filter Expense Categories by Roles

If you want additional details recorded for Cash Advance or Cash Return, please refer to: Creating Custom Fields in Nexonia Expenses

Comments

0 comments

Article is closed for comments.